Lock-for the attacks could be the norm, but if you will be extremely fortunate, you will be those types of those who subscribed to home financing plan with no lock-in the. This can takes place for those who closed your house loan during the a beneficial price battle within finance companies.

We have mentioned previously different will set you back off refinancing judge charges, valuation charge, prepayment penalties into the lock-when you look at the period.

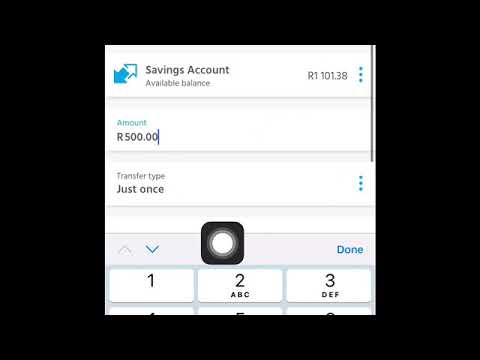

However, these will cost you will be subsidised because of the financial under some affairs. They usually do that to possess a fantastic loan number a lot more than $500,000.

If you are everyone loves an effective freebie, think cautiously about taking on such court subsidies because they can sometimes incorporate conditions and terms. Generally, such identify a particular years referred to as clawback period, which is the big date you will want to stay with the bank before you can refinance to a different bank as opposed to a punishment fee.

To phrase it differently, that is yet another lock-when you look at the period to suit your new home mortgage. If not adhere to which lender during the course of it, the financial institution often claw right back this new freebies it offered you.

Another cost of refinancing is named brand new cancellation fee. That is sustained for folks who refinance home financing package whenever the house or property has been uncompleted. Having property significantly less than design, the home loan amount is actually paid for the levels. Brand new cancellation commission matter is just about step 1.5% of loan amount that wasn’t disbursed but really.

If you’re not delighted regarding your most recent household loan’s growing appeal rates, you actually have another option other than refinancing repricing. Repricing a home loan is a lot like refinancing aside from you stick to a similar bank and switch to a new financing bundle which they offer you.

The amount of time it requires so you’re able to reprice are less as compared to refinancing, you can switch to a lower interest rate package eventually.

Repricing does not require judge fees and a new valuation of the home doesn’t need to become conducted. However, this isn’t necessarily less expensive than refinancing, specially when your register for loans that come with judge fee subsidies.

This new unfortunate simple truth is you to banks usually are more complicated discover clients than just maintain existing users. Youre prone to see a aggressive interest when you re-finance than just after you reprice.

An experienced homeowner need to discover what the brand new refinancing options are in the industry, after which have a look at back with the bank if they can bring a competitive repricing package.

Quite often, repricing might be best just for people that have a small the amount borrowed away from $2 hundred,100 or faster, just like the price of refinancing shall be tall compared to the the amount you save.

Summary: To help you refinance or perhaps not in order to refinance?

If the the amount borrowed was above $500,000, then you certainly is always to you should think about refinancing. It’s simpler for you so you’re able to re-finance for cheap as most financial installment loans no credit check Memphis MI institutions commonly ingest the brand new judge charge.

And you may as a result of the low-value interest ecosystem, you might snag a low interest rate mortgage easily on second. The audience is speaking of rates as low as step one.29% p.a. – much, far lower than simply HDB’s dos.6%.

When your a great mortgage was less than $500,000, you can nevertheless refinance, you possess less choices while the just a few banking companies have a tendency to subsidise the court fees.

Such as for instance, when your amount borrowed is very large enough, banking companies might possibly be ready to defray this new legal charges which have subsidies

In cases like this, you can examine out both refinancing packages with courtroom payment subsidies While the repricing alternatives given by your financial.