Although people obtaining an informed family equity finance commonly just be able to accessibility preparations having 15- otherwise 29-seasons periods, Regions now offers many installment lengths performing within 7 age.

Its repaired-rates household guarantee loans begin in the $10,100 and can rise to help you $250,one hundred thousand

Fixed rates getting household collateral money using Countries Financial begin within step 3.25% and you will installment loan Richmond increase to %. Discounts for auto-shell out enrollment can also be straight down you to rates to 3.0%.

Towards earliest 6 months, people which explore Regions Lender for an effective HELOC will take pleasure in good fixed introductory price out-of 0.99%. It then expands to a varying rates losing between step 3.75% and %.

Countries Financial supplies the most useful household guarantee financing and you will HELOCs. Payment conditions can be eight, ten, fifteen or 20 years.

The newest HELOCs begin at $10,000 but have a total of twice their property collateral funds, having $five-hundred,000 available for certified people. HELOCs functions differently than domestic guarantee fund in some ways; you’re one to installment will not initiate up until immediately after what’s titled a draw months, in which property owners can also be use off their HELOC. Places Financial offers HELOCs having 10-season mark symptoms with 20-season payment symptoms.

To possess HELOCs away from $250,one hundred thousand or below, Places Bank takes care of every settlement costs. To have lines of credit significantly more than $250,100, Regions Bank usually contribute as much as $five hundred to closing costs.

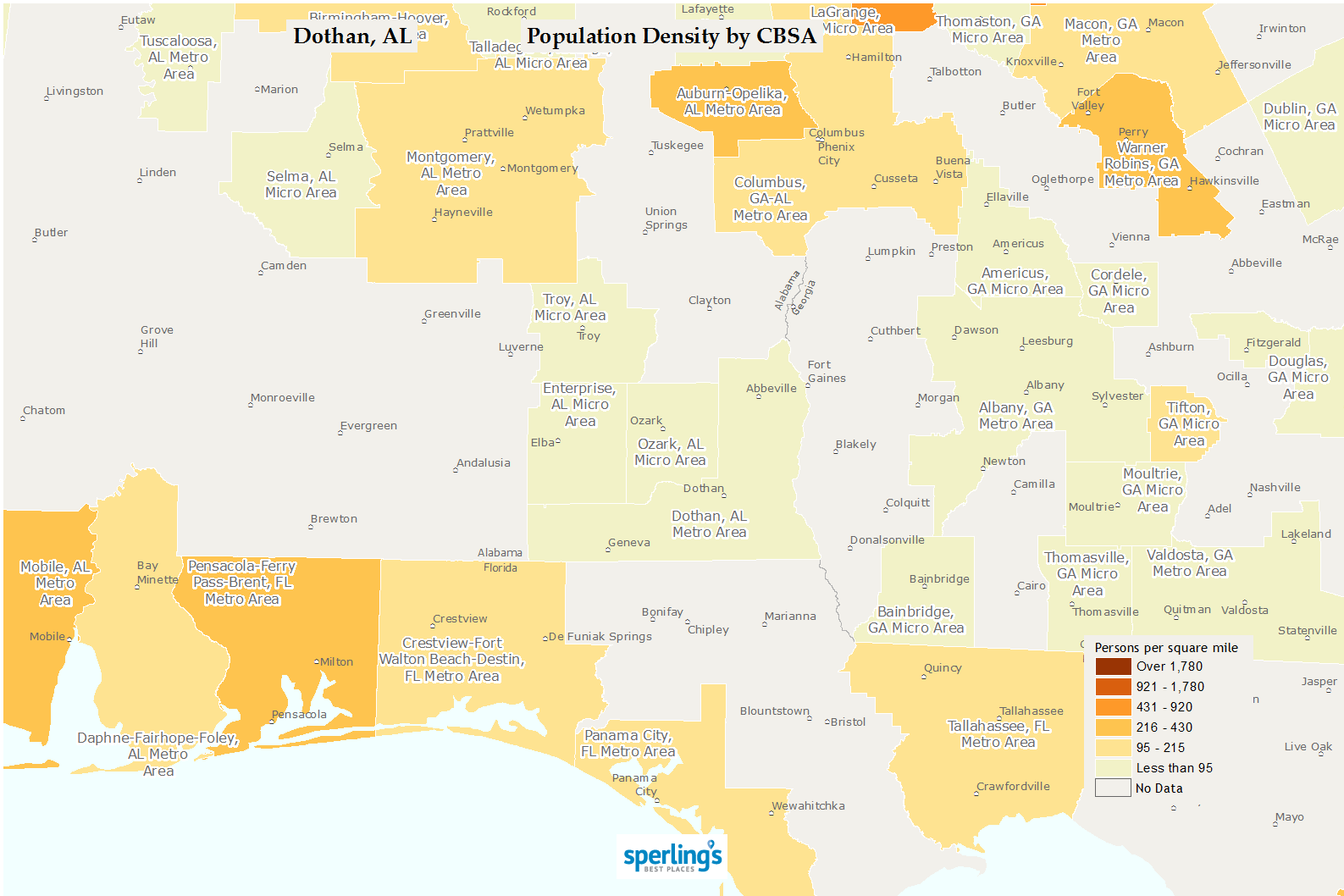

The minimum credit history required for a regions Bank domestic equity financing is not uncovered. In case your property is maybe not situated in among the sixteen claims where Nations Bank has a part, you will not be able to get a home security financing or HELOC due to him or her. Already, Places Bank only has twigs within the Alabama, Arkansas, Florida, Georgie, Iowa, Indiana, Illinois, Kentucky, Louisiana, Mississippi, Missouri, New york, South carolina, Tennessee and you will Texas.

A knowledgeable house guarantee finance and you can HELOCs is applicable to have on line, physically within a regions Bank branch or by the cellular telephone from the 1-888-462-7627 from six a good.yards. in order to eight p.meters. Saturday using Saturday and you will 8 a good.m. so you can 2 p.yards. toward Saturdays. You should use Region Bank’s calculator to see if property equity financing is a possible option for you to definitely consolidate your financial obligation. You may want to calculate your prospective HELOC costs having fun with Region Bank’s fee calculator .

- Truist will pay for your assessment

- Cost choices are versatile

- Fixed-rate installment choices are available

- Having residents away from Alabama, Fl, Georgia, Indiana, Kentucky, Nj-new jersey and you can Kansas, an annual commission applies

- Penalty having closure personal line of credit in this three-years

Called for guidance boasts your recommendations and therefore of your own co-applicant while you are applying as you, employer suggestions, economic property and you can expenses and you can a conclusion of collateral, as well as your bank name and you can equilibrium so you can worth

For these selecting a property collateral credit line, Truist are a stronger solution that have a decreased minimal borrowing from the bank matter and you can a relatively small techniques big date.

Truist’s rates take new high side, carrying out in the cuatro.5% and you may heading all the way as much as 16% or even the nation’s restrict.

Truist’s HELOCs features a minimum of $5,100, however the maximum utilizes the latest applicant’s creditworthiness therefore the amount off security found in the home. Payment can be made more than 5, ten, 15 and you will 20-12 months words getting repaired-rates HELOCs. For those having variable cost, regardless of if, the draw several months is actually ten years additionally the cost several months try 2 decades.

Truist’s greatest family collateral fund are available in every states, although organization does not identify at least credit score called for for applicants. To meet the requirements, homeowners need enough guarantee in their house and you may have shown its creditworthiness thanks to fundamental mortgage paperwork eg a position confirmation, credit history, W-2s and much more.

For these searching for a simple turnover, Truist is actually an excellent solution which have a single-day recognition time for licensed applicants.