Hence? Recommended Provider to own mortgages 2022

We’ve got entitled Very first Lead a that’s? Needed Provider, based on a variety of comes from the 2022 customer satisfaction survey and specialist financial analysis.

Very first Lead hit a customers get regarding 80%, that have five famous people for all aspects of the service, and you can all of our analysis think it is constantly offered a few of the cheapest mortgage loans in the industry.

I plus analysed fourteen most other names. Keep reading to ascertain and therefore brands along with scored extremely with users toward elements such as for example value for money, app techniques, customer service and much more.

Every year, we survey tens of thousands of home loan users to reveal the fresh organization best just how on the services they give you. We plus evaluate a huge number of residential mortgages to find the loan providers providing the best profit.

Customer happiness

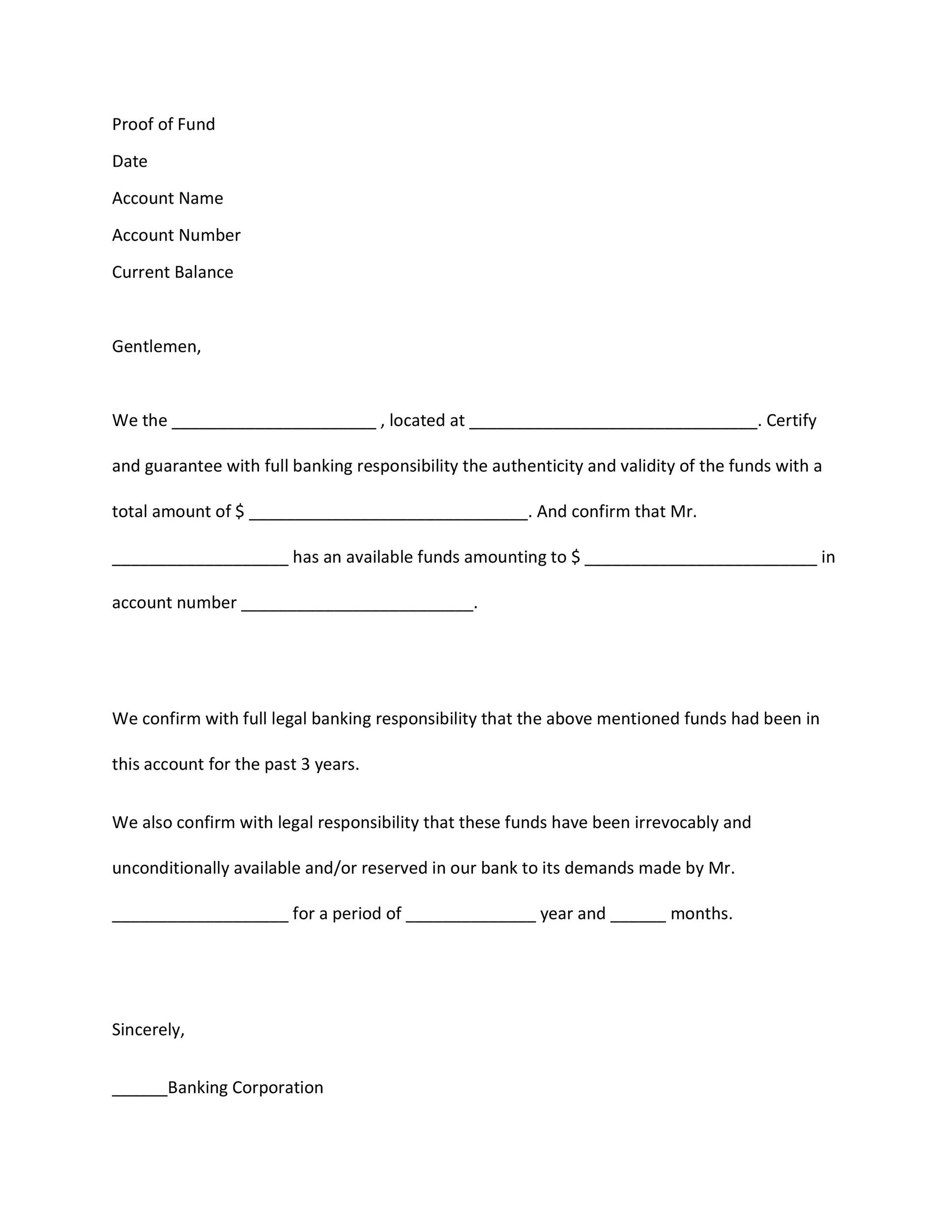

From inside the , i interviewed 3,262 members of people about found these people were making use of their home loan company. This is what i located:

Dining table cards: Customers get predicated on a study off 3,262 people in people within the . The common buyers get is 70%. Superstar reviews out of four tell you levels of fulfillment with every area. Customer score try exercised having fun with a variety of complete satisfaction together with probability of suggesting new vendor in order to a pal. When the 2 or more labels reveal the same complete score, he could be ranked alphabetically. Providers have to found the very least decide to try size of forty to own introduction on the desk. In which a good ‘-‘ is revealed i have an inadequate decide to try proportions (lower than forty) to calculate a star score. Test brands inside the supports: Accord Mortgage loans (52), Barclays Mortgage (295), Coventry Strengthening Area (67), Earliest Lead (82), Halifax (458), HSBC (240), Leeds Strengthening Area (47), Lloyds Lender (111), All over the country Building Neighborhood (600), NatWest (283), Platform/ The new Co-Op (49), Royal Lender out of Scotland (59), Santander (391), TSB (92), Virgin Currency (62).

Deals analysis

The pros as well as analysed countless mortgages over a several-times period inside the . They built-up some dining tables of the market leading ten cheapest marketing considering various borrowing circumstances, and counted how many times each bank seemed inside the a dining table.

The average quantity of times a loan provider made it to the good least expensive revenue desk was 16. 7 names did over the average:

- Earliest Head

- Regal Bank away from Scotland

- NatWest

- Halifax

You will discover much more about our contract investigation, and how per lender did, within our private lending company reviews.

Precisely what does they decide to try getting a that will be? Demanded Merchant?

- provides reached a premier consumer score in a definitely? customer satisfaction questionnaire

- constantly bring desk-topping home loan deals over various tool versions

And therefore? directly checks the products and you will practices of all of the necessary company, and you may reserves the ability to ban any business that will not treat its people very.

How to choose a knowledgeable home loan company to you

Including, certain loan providers be a little more willing to offer mortgages to notice-operating homebuyers, and others specialise during the guarantor mortgages otherwise selection for those who have a decreased credit rating.

The best financial for you wouldn’t just be determined by who has providing the reduced interest or even the greatest mortgage.

Determining the most likely sorts of home loan if it is a predetermined-rate, tracker otherwise disregard is crucial to be sure the borrowed funds meets your needs.

It’s adviseable to browse the fees which can be linked to the package, since these can add plenty as to the you can easily spend full.

When you find yourself not able to learn and therefore lender deserves choosing, you have to know delivering information from a different, whole-of-sector mortgage broker before you apply to own home financing.

Exactly how financial team regulate how much so you’re able to give your

When purchasing property, it isn’t only the put you will want to think about but plus the measurements of home loan you can purchase.

Loan providers must heed tight home loan cost rules, for example they must provide responsibly and make certain you could potentially be able to pay the loan, both today plus in the long run when rates might go up.

Simply how much can i acquire?

The amount you can acquire will be based on your own income, whether or not you’ve got any dependents and you can certain outgoings for example monthly payments towards credit cards or other money.

In most cases of flash, lenders constantly allows you to acquire to four-and-a-half of moments your revenue, but this will are different considerably with regards to the supplier you utilize in addition to their credit standards.

Including, specific loan providers deliver high money multiples to the people which have large money, those individuals credit within a reduced financing so you’re able to value (LTV), otherwise people who have safer work within the specific marketplaces.

Because of this discover a positive change of 10s out-of thousands of pounds between how much cash other lenders enables you to borrow, and you would not actually know how much cash you should buy away from a certain lender if you do not pertain and you can proceed through the full credit have a look at and financial cost research.

But it’s value speaking with a mortgage broker before you apply for home financing. They’ll certainly be capable indicates roughly exactly how much you could potentially use, including and that lenders are likely to just accept you.

Exactly what are the biggest lenders in the united kingdom?

Based on data off Uk Money, the most significant lenders in the 2021 was basically below. Links elevates to your recommendations of each and every supplier:

Choosing a major lender have certain masters like, they frequently promote a thorough range of products, and also so much more twigs offered.

However you don’t have to squeeze into one of several huge participants even though you realise title, otherwise you will be already a buyers. Smaller loan providers, in addition to building communities, may offer designed products that top match your style of items.

If you need help managing your money for the cost of lifestyle drama, try our very own totally free My Money Health check equipment getting customised currency-rescuing information.