For decades, opposite mortgage loans have served as an important equipment having older people as the they transition outside of the workforce. Contrary mortgage loans may help retirees enhance retirement benefits, Personal Security gurus, or any other article-senior years money provide.

Contrary mortgage loans – specifically, household guarantee transformation mortgage loans (HECMs) – have become more appealing than in the past on the 62 and you may older audience. Individuals within this group tend to have a lot of security inside their belongings and have the wish to complement its repaired month-to-month incomes.

As the conditions reverse mortgages and you can domestic collateral sales mortgage loans are usually utilized interchangeably, they may not be the same. For people who or a loved one are considering taking right out a good reverse mortgage, you need to be aware of the distinction between these financing affairs.

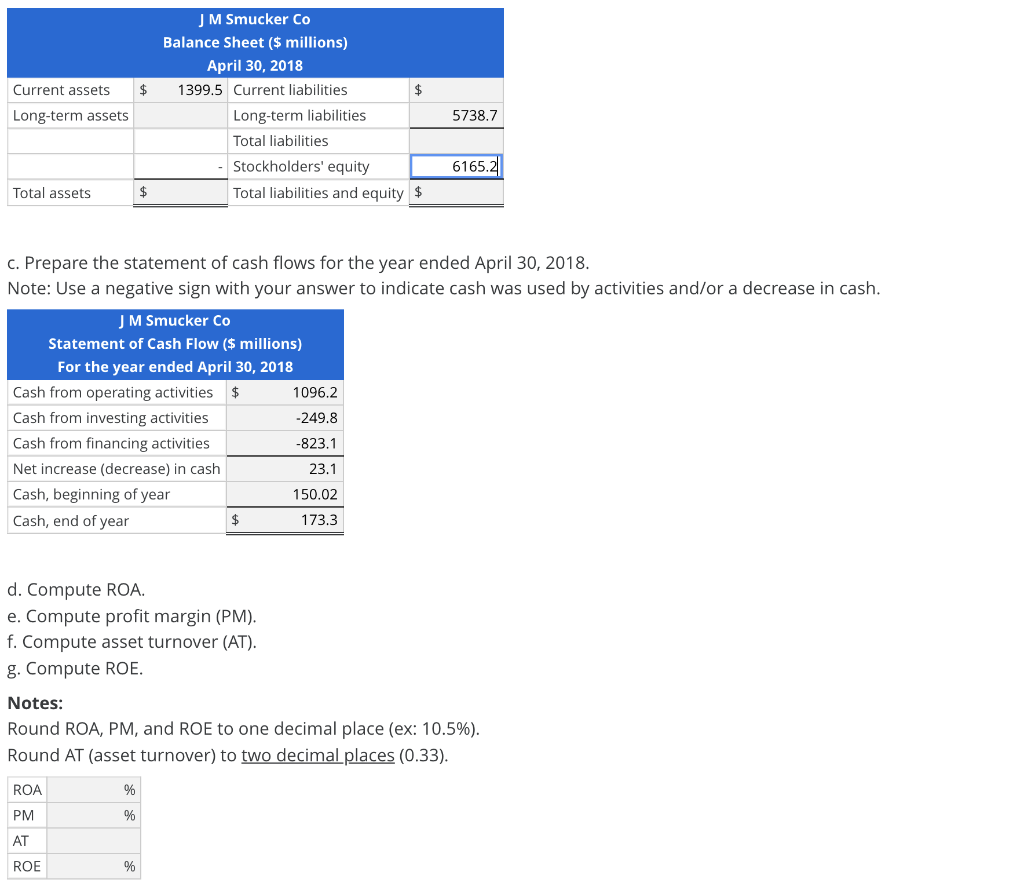

This informative guide measures up opposite mortgages that have HECMs. It then traces opposite mortgage benefits and drawbacks, discusses how these items functions, and you can refers to the fresh new fees techniques.

What’s a reverse Financial?

Opposite mortgages allow home owners to tap into the fresh equity within their homes to get money from a loan provider. The lender have a tendency to usually disburse such funds in one single swelling-contribution fee. The bill towards financing tend to constantly rise as it accrues attention, but property owners aren’t needed to build month-to-month home loan repayments.

Conventional mortgage loans and you will contrary mortgages is actually equivalent in certain key suggests. In both days, the newest citizen uses their house given that guarantee in order to safer fund. The newest name will also stay static in brand new homeowner’s term if they keeps a timeless or opposite financial.

- HECMs

- Exclusive opposite mortgage loans

- Single-objective contrary mortgage loans

Single-mission reverse mortgage loans are unusual. This is because receiver can just only utilize the finance for just one goal, eg performing household maintenance otherwise using assets taxes. The lending company has to approve the intended goal, together with citizen ought to provide proof your loans were utilized having told you mission.

Proprietary reverse mortgage loans was a kind of personal mortgage. He could be insured and available with private financial institutions, and the federal government doesn’t straight back all of them. Exclusive opposite mortgages has a few secret perks: The funds are used for nearly some thing, while the homeowner is really as more youthful because the 55 years old based on hawaii.

How come a contrary Mortgage Functions?

Is entitled to a reverse home loan, you ought to either own your property downright otherwise provides a low leftover equilibrium in your established mortgage. Funds from the opposite mortgage payout can be used to blow from people left equilibrium once you intimate on your own financing.

A lump sum payout provides the highest total cost because you pays interest with the full amount borrowed when your personal. On the other hand, your loan equilibrium increases slowly for individuals who decide for almost every other payout choices that would be for sale in your location.

What exactly is a home Guarantee Conversion process Home loan?

A home collateral conversion financial are a specific types of contrary mortgage. It is novel because it’s insured by Federal Houses Government (FHA). Which also offers specific defenses to have borrowers and their heirs. To access so it federally covered loan unit, consumers need to be 62 or more mature.

Like with other contrary mortgages, HECM fund is employed to repay the remainder financing harmony whether your homeowner doesn’t individual the latest residence downright. Following that, the amount of money could be paid to the homeowner.

HECM individuals need not generate monthly mortgage payments. Yet not, its financing balance can get continue steadily to rise up until it no longer individual our home. The amount of loans that a debtor is also discover hinges on three things:

- Age the brand new youngest debtor

- Requested interest rate

- Value up to FHA’s national credit restrict off $970,800

How does an excellent HECM Performs?

HECMs are created to enhance the cash ones get yourself ready for or already inside later years. When you are HECM consumers are not needed to create mortgage payments, they want to consistently shell out home insurance and you can possessions taxation. They are also compelled to manage their property therefore it retains their well worth.

Certain borrowers like to make money, even though they commonly needed to get it done. These repayments you’ll reduce the number of attention or even the full financing balance.

- Becomes deceased

- Offers new home

- Motions out from the house

The fresh new borrower’s heirs are not compelled to repay the loan. Instead, they may be able choose give-up the home for the bank.

Trick Differences when considering Opposite Mortgage loans and you may HECMs

Opposite mortgages are around for consumers that 55 and elderly for the majority says when you find yourself HECMs are just readily available while you are 62 otherwise earlier. HECMs have a whole lot more autonomy inside their commission solutions if you are reverse mortgages only cash advance online Oakwood GA bring just one-lump sum quite often.

HECMs and you can opposite mortgage loans are classified as non-recourse finance. Individuals neither its home will never be privately responsible for more industry worth of their houses.

Qualification Requirements for these Home loan Issues

For those who see such conditions, HECMs may be the easiest types of reverse financial in addition to really standard solution to enhance advancing years income.

How do you Repay an opposite Financial?

For individuals who stay-in our home throughout your lifetime, the newest debtor or its house would-be tasked that have paying down brand new financing equilibrium. They can do so in one of three straight ways:

Whether you are researching household equity conversion process mortgage loans yourself otherwise a family member, these types of lending products are among the how can i supplement money for the retirement. HECM funds include individuals in addition to their heirs when you find yourself getting retirees which have the money they must see its wonderful ages.

If you would like to learn more about reverse mortgage loans or HECMs, get in touch with the local expert from the CrossCountry Mortgage or get a hold of that loan officer.