Warning is good even if if this helps anybody bed in the evening, in the event in my opinion some body manage overworry or otherwise not realize there are worse away from people that endure…

Toward lowest reduced I would recommend so you can isa its private savings and you can uplift so you can sipp afterwards, they doesnt generate a mathematical difference to use the fresh taxation uplift later on

just to right the new factual discrepancies. This is not it is possible to, overall, in order to withdraw out of your your retirement early. After all. It is not an issue of merely paying a punishment. (But sometimes from big ill health and some most other conditions and terms conditions).

Awesome a trip de- push toward an interest I’d never ever also thought; although We paid off my personal mortgage out-of some time straight back. High work !!

Interesting blog post I’m offered creating merely that it. 275 k mortgage 55% ltv 107k isa and you can 250k your retirement in the years 39 most toying with the thought of supposed io

you county, vis a vis house prices heading down you to sure it might happen in new short term. Well, think about 10 otherwise 11 ages? That’s how much time they grabbed household costs in order to nominally get well just after the 1989 crash. That’s Okay alone, save for these swept up inside a home they will not need to be in and constantly fretting about your debt and this isn’t really reduced, but the majority family speed slumps are caused by/coordinated that have something different recessions and unemployment. For many who clean out your task, you’re in trouble.

I have had a sense that your particular merely connection with inventory /9. This was extremely atypical. Really crashes match mass work losings, ascending home repossessions and you may past an extended, while.

Yourself I’m not sure its really worth the risk. There is certainly one situation where it does seem sensible in which you keeps a big financial and cost usually consume a great number of your disposable. In this instance the possibility of shedding your job and achieving uncontrollable money and risk of being unable to conserve a beneficial ount for the future each other make disagreement stronger compared to the risk. Where cost is a fairly low part of throw away, in order to rescue such anyway and do not has actually for example stress if you lose your task, I am not sure exactly why you carry out do the exposure. And you can essentially most people are about latter classification (appreaciate realisitcally some are probably on the former).

For those who might get a loan for the same prices, do you really acquire to expend?

Needless to say its a lot more risky while the no root investment, but you to definitely house might not be well worth what you would like from the enough time something go belly upwards given that others has actually alluded in order to (naturally its unlikely the fresh new advantage might possibly be meaningless, so a bit shorter chance). As well rich for my personal bashful blood

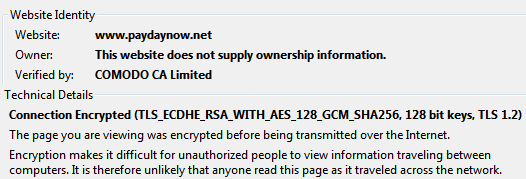

Check this out before now and you will consider it may create one thing to which conversation Before scanning this Moments blog post I did not know one to such as for instance financial freedom lived at least theoretically. Before in daily life Used to cashadvanceamerica.net loans for bad credit online do explore that which was up coming entitled a beneficial region and you can region [it turns out, repayment] mortgage but that just expanded so you’re able to part are totally flexible, and part are repaired rate in order to hedge my bets.

Little into the first 9 months, after that that loan for some of your own mortgage notice

It just makes sense for individuals who assume relativly good home worth appreciate over the years and some down interest rate. I’d say greater than X * rising prices and you may Y* you_interest_rate (X and Y can be determined, along with income tax rate). Just like if you lent money to shop for an asset and wish to understand capital growth as time passes. As well as you will get additianl great things about houses minus costs depreciation. All this work are computed and additionally you should use change cost observe what the sector forecast desire might be when you look at the 20 season.