To shop for a house overseas is an exciting excitement. However, one of the primary difficulties it’s also possible to deal with is on its way up with the money for the financial support.

Yet not, you do have several options when it comes to funding overseas home, whether or not we should get a vacation domestic, an investment property while you are your youngster training overseas, otherwise a place to retire to help you.

An offshore mortgage are any home loan you take out on an effective property that is not on your own country from house. It could be out of a city financial, or off an offshore financial in the united states we wish to purchase for the. Their method is dependent upon yours and you will finances, so it’s crucial that you do your research. Weigh the pros and you will drawbacks of every choice to help you pick.

Specific finance companies and you can strengthening communities, in addition to HSBC, provide all over the world financial services and can help you arrange an international financial. You’ll need to be sure it service your preferred country or territory.

Just remember that , to find a home overseas are going to be an excellent completely different process than what you may be familiar with. You also may not have an identical legal protection, according to area.

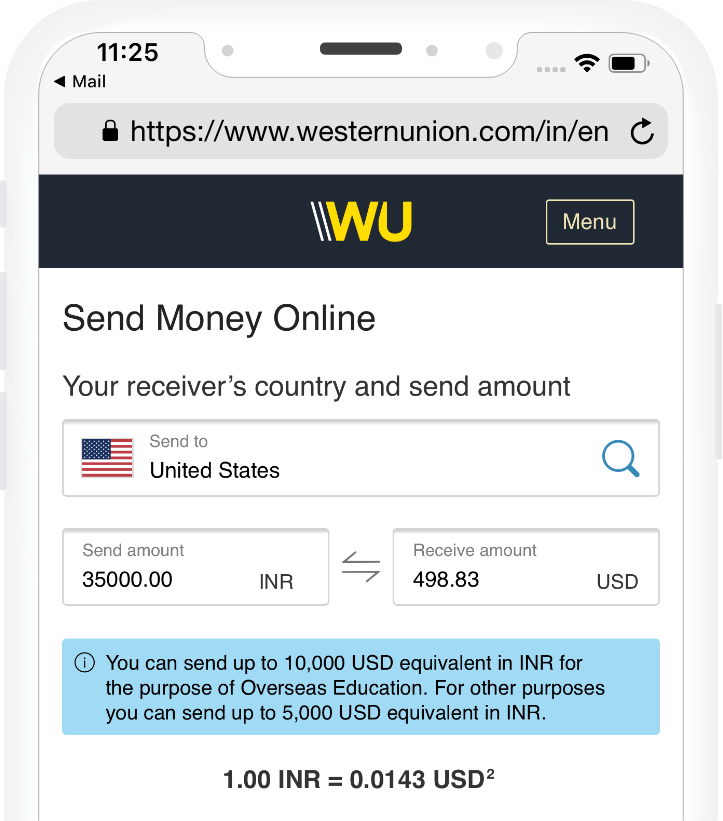

Just how to money an overseas possessions

Anything else to adopt are overseas ownership guidelines; tax rules; foreign exchange motion; believed permission; your exit plan, should anyone ever plan to sell; and you will insurance. Aided by the info you iliar which have, it’s important to prefer a lending financial that understands your neighborhood guidelines and has international experience in the world we wish to get inside the.

If you use a location lawyer, make sure they are qualified to behavior on your newest country and you will to another country, if at all possible even specialising for the international real estate transactions.

Apply for a mortgage regarding an overseas financial

Although not, it could be very difficult to get home financing to another country, particularly when you will be a non-native. Of course, if you do be able to get one, the eye costs could well be higher than if you were a location. By using out home financing with an offshore financial, your repayments are likely to be into the a foreign currency, which might let when you need to do foreign exchange motion.

Your money will go then when your house money are solid in line with neighborhood money to another country. However,, if you will find motion therefore see your money fall, your repayments becomes more expensive if you are transforming their devalued currency toward to another country currency to fund him or her.

By using an international financial, it’s best if you use their, separate attorney and you may translator to protect you against swindle.

As much as possible afford to, assuming you really have enough collateral involved, you can even consider refinancing home and making use of that money to cover property overseas.

Guarantee is the worth of just how much of your house your own. This means, it’s the amount of money you’ll rating immediately after selling your property and you can settling your own mortgage. Such as for example, in the event the home loan balance is USD100,100 and your residence is worth USD400,one hundred thousand, that means you have got USD300,100 security in the assets.

You can boost your house security because of the overpaying your mortgage payments, hence sets extra cash with the property, or if the value of the home rises, both because of renovations or beneficial industry requirements. And make additional repayments will also help you only pay off their mortgage https://paydayloanalabama.com/moores-mill/ before and relieve the level of interest payable. You may want to, not, feel energized having early fees; this will depend to your particular financial you really have.

Launching guarantee was a way to free up a few of you to worth since the cash in order to fund an international possessions. Think hard in the this though. Of several such mortgages fees material desire which can add up if the that you do not pay it you go collectively. Additionally located less than what your residence is worthy of to the the market industry in exchange for the bucks.

Once you borrow more money against your house, the measurements of your own financial along with your monthly money will boost. You should make sure to are able to afford this new money to help you prevent your property getting repossessed. Family rates may go off and upwards. In the event the worth of your residence drops, you could enter bad security. That is where you’ve borrowed extra cash than your home is really worth.

In some nations, eg Australia and you can Canada, banking institutions doesn’t undertake international property as the protection having property loan. They together with restrict your borrowing so you can a certain part of the newest property’s well worth (constantly doing 80%). That is known as Mortgage so you can Well worth Ratio (LVR).