Precisely the websites in this post allow you to deposit via your cell phone bill or Pay-as-you-go balance. At the time of writing, one another Mecca and Gala don’t have it features so we recommend your read the various possibilities you can expect. With regards to the payee, the lending company tend to thing an electronic commission or a paper look at playing with fund removed out of your appointed account in a few days once you schedule the bill pay. Of many banks enforce zero limit to the level of expenses your can pay through the ability.

Postpaid Mobile Costs Fee Faq’s – find more information

The easiest percentage choice when you need making a much bigger pick far more under control through the years. Klarna now offers money agreements one to range between six-two years which have interest levels between 7.99%-33.99% Apr. Breeze a photo to include the borrowing from the bank otherwise debit card to help you Yahoo Handbag. Once you’re at the channel, merely hold your own tool for the card reader unless you see a blue checkmark.

The way you use Fruit Pay

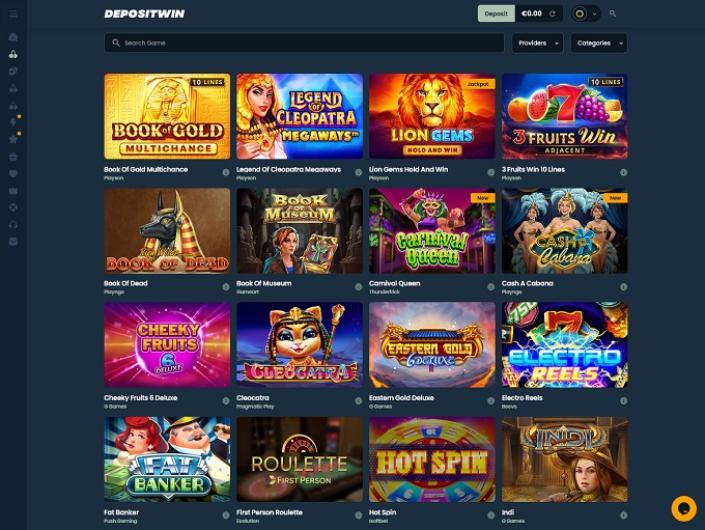

You can winnings around 500 100 percent free revolves on the NetEnt’s Starburst once you sign up and also the Pay From the Mobile payment experience qualified. On the internet gamblers has various other cellular asking features to pick from whenever to experience in the spend because of the cellular telephone casinos. Listed below are some the pro checklist lower than and see a few of the best team as much as and you will what all of them brings to the table. Fortunately one to all portable companies enable customers on the versatility to pay by the smartphone from the a great casino.

After you have signed for the app with your Yahoo membership, contain notes or hook your own lender. Once your Google Spend membership features access to finance, you might pull up the fresh application in the an enroll and faucet the newest credit-audience to pay with one of the notes in your Google Pay purse. From the its easiest, Yahoo Pay try a pocket in which you store the notes. Having Google Spend, you can use your Android cellular phone to help you accentuate classification costs and you can track the expenditures.

- To the Account Summary page on the Asking point, your debts might possibly be noted since the Number Due.

- You can earn cash back or other rewards1 for the eligible purchases from your favourite names.

- Cracking their cell phone — or with they stolen — try a horrible sense, especially since the repair otherwise replacement will cost you is going to be too much.

- Samsung Knox includes fingerprint recognition and you may encryption of one’s analysis so you can make sure that your it’s safe.

If you are searching to possess an alternate to pay debts, unlike sending report inspections through the send, consider using an online statement shell out service. Whether for example-go out otherwise find more information ongoing payments, an on-line bill spend provider may be a more smoother solution for using expenses. Google Pay is actually a digital bag app which allows profiles to generate contactless costs, generate on the internet money and you may publish currency to family members.

Visibility can be $600 per allege having an excellent $twenty five deductible, which have up to a couple of claims all of the 1 year. There are not any charge to deliver and you can receive payments thru Bucks Application help save to possess a step three% payment when giving with a credit card. There are even fees to own immediate places (0.5%-step 1.75% with a minimum of $0.25) and Atm distributions.

Second, you should get an excellent T-Cellular ID (the newest ID is equivalent to the regular on line tmobile membership). Thoughts is broken logged within the, you might set up almost every other accessibility tips, as well as face and you can fingerprint possibilities. There are many T-Cellular spend bill steps you to definitely cover to make one to-time costs. But once you have saved your favorite percentage actions in my T-Mobile, you possibly can make anything easier yourself by enrolling to have AutoPay. From 11 Will get 2019 this really is today necessary should you decide purchase a fee so you can cellular services reached thanks to an internet flag otherwise advertisement. Next, you’ll be asked to create and you can enter into twice an excellent half a dozen finger code allow fee.

You have access to an excellent 0% equilibrium transfer Apr promotion, which is rewarding if you want to prevent interest charge and you may accrual from other credit cards. Following the 0% several months, normal Annual percentage rate, as mentioned over, applies. Wells Fargo Perks are good because of the flexible redemption options they provide. That have cellphones generally a requirement to possess everyday routine, odds are your’lso are paying a monthly cell phone statement.

That’s one of many large payouts on the cellular phone business benefits you’ll find. Few it credit which have a good Chase Sapphire unit for even higher access to the brand new take a trip portal and traveling transfer people. Prior to i plunge to the how-so you can, let’s easily discuss why investing together with your cellular telephone costs are a good solution. And you can subsequently, you wear’t need to worry about revealing your financial and private facts on the internet, all you need is their cell phone number.