ET, the take a look at was processed another working day. Some otherwise the Eno has may possibly not be available to all the Money You to definitely customers, according to the sort of accounts kept. Including, specific bank account are not eligible to text message having Eno, and you may Eno email address notifications, application announcements and you may digital card amounts away from Eno may not be designed for certain handmade cards. Cellular consider put try a fast, easier treatment for deposit finance with your smart phone. And also as financial tech and you will electronic money government devices always progress, the procedure has become secure and easier than before. Second, endorse the new look at you wish to put—as you manage if you were transferring it at your regional branch.

You can even find out about almost every other deposit options at the same time if you need to add the view for your requirements As quickly as possible. Cellular dumps are thought since the safe and sound because the any bank-recognized kind of placing a. The newest Pursue Mobile application, as an example, never ever places passwords or image study on your device when using Pursue QuickDeposit℠.

We’re the Citadel, and now we is Building Energy Along with her. If you would like put several monitors simultaneously, extremely ATMs clear up transactions because of the accepting numerous inspections at a time. But with secluded dumps, it may be labor-rigorous to help you check and procedure for each and every consider, one by one. But it is crucial that you note there might be strong punishment in the event the a bounces after put.

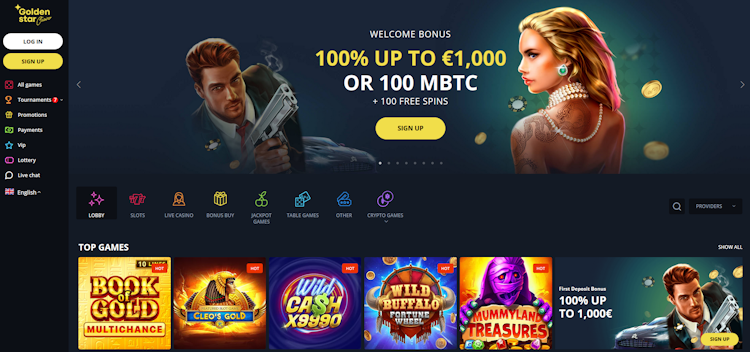

Rainbow Riches play for fun – We are here to take control of your currency now and the next day

No factual statements about account quantity otherwise handmade cards is needed to generate payments together with your mobile phone, which never needs to be shared with gaming locations. Cellular look at deposits typically get between about three and you will 5 days in order to process, make certain and you will obvious. In some cases, only area of the view get clear quickly, as well as the people clears the following working day.

Associate Functions

Mobile deposit, known as cellular take a look at deposit, is actually an electronic treatment for put report monitors into the examining otherwise family savings utilizing your mobile and other smart phone, for example a tablet. It’s a safe and you will safer treatment for put a as opposed to needing to trip to the regional bank part or Atm. And, you need to use mobile put twenty-four/7 from anywhere you have got phone solution or Wi-fi—though it’s better to prevent on the internet banking on the a public Wifi system to help keep your advice safe. Cellular put mode people can also be deposit monitors twenty-four/7 and get away from travel so you can an actual bank or borrowing partnership department. Money from mobile look at places are typically readily available 24 hours later, compared to four working days to have a magazine look at.

Miss the branch. Put monitors to the Wells Fargo Mobile app.

Same as a consistent look at, their bank is place a hold on the funds deposited because of the mobile. A common cause of therefore-titled delayed supply of money is the fact that fund was transferred far too late every day. Just after a particular cutoff going back to consider places, the new depositor may need to wait a supplementary business day for the newest view to pay off and also for the finance being readily available. You could potentially wonder who can gain access to the new delicate information exhibited to the a, but view images aren’t kept on your own cellular telephone. Instead of bringing a check to the financial, mobile view put makes you snap photographs of your front side and you can straight back away from a, upload them to an application and you may deposit the fresh take a look at electronically.

None Lender nor Merrill is actually a factory away from methods or app. “Capture Tool” setting one tool acceptable to help you you that provides to the get from photographs away from Issues and for signal from the clearing procedure. There Rainbow Riches play for fun isn’t any a lot more payment for making use of Mobile View Deposit however, we recommend that you consult your supplier to see in the event the you will find people cordless supplier charge. Appointment arranging is provided by Engageware, whoever privacy and you will shelter regulations or steps may vary out of Countries.

On the internet Features

For individuals who refuge’t installed debt organization’s mobile application, you’ll want to do it before you can make a mobile put. Your generally can find your own financial’s software on the Application Store (Fruit gadgets) and you may Google Gamble (Android gadgets) programs. You need to use mobile deposit for most paper checks, as well as individual checks, team checks, and you will government-awarded checks.

The availability of the financing would be put off if the here’s an issue with the new deposit. You’ll get an immediate email notification guaranteeing you to we’ve obtained your put and something whenever we’ve got acknowledged they to own running. Control Pictures.You authorize me to procedure any Picture that you send us otherwise move an image to an image Replacement Document. Your approve all of us and every other lender that an image is distributed so you can techniques the image or IRD.

Company credit cards

- Put the money to your family member’s otherwise pal’s membership and they have the brand new independence to spend the money for the calls or any other communications features offered at its facility.

- Ally offers simple, totally free and safer online consider deposits because of Ally eCheck℠ Deposit.

- Friend Purchase cannot give income tax suggestions and does not depict any way that the outcomes explained here will result in one kind of taxation results.

- In the event the difficulty is to develop and also the unique view is no extended offered, delight contact the fresh issuer of your view to get a new duplicate which can be resubmitted to have put.

- The same as a bank statement, you need to throw away the brand new look at properly immediately after time has introduced.

- The purpose of verification is always to be sure inmates commonly linking having inappropriatepeople on the outside.

A digital cooperative must pay focus for the places only when their bylaws enable assignment out of margins to help you participants or users. Sure, your organization power may need in initial deposit to ensure coming percentage, as mentioned on the utility’s composed deposit rules. Here are a few our very own helpful ‘Ideas on how to’ instructions for all you need to know to browse the working platform in addition to detail by detail advice away from protecting a deposit through to solution.

You’ll find deposit limits, and they believe the fresh deposit approach. To find out more about precisely how enough time it requires for cash in order to relocate and you will from the membership, kindly visit the money availability webpage. Definitely keep your check in a safe place up to you find a complete put matter placed in your account’s previous/current deals. Once you manage, make sure you ruin the brand new consider quickly from the shredding they or having fun with various other safer approach. That it connect takes you to help you an external web site otherwise software, having additional confidentiality and you may defense rules than just You.S. We don’t very own otherwise control the items, features or blogs discover there.

Mobile an internet-based

When you are questioned becoming Telmate Verified this means your business means verification of the term ahead of greeting from inmates’ phone calls. The intention of confirmation would be to make certain inmates commonly hooking up which have improper people externally. Gather calls allows you to instantly undertake and purchase phone calls to the land-line mobile phone account. After going into the deposit suggestions you can import the brand new put to SafeDeposits Scotland by debit cards, cheque otherwise BACS. And connected banking institutions, People FDIC and you may wholly owned subsidiaries of Bank out of The united states Business. Phone calls is actually restricted to thirty minutes per phone call, excluding the new inmate’s attorneys.

We cover all of the guidance you send out us having tool identification tech and you will mobile banking study security. For your security, i never store their passwords or even the take a look at put analysis and you will pictures in your smart phone. That have Chase to have Team your’ll receive advice away from a small grouping of organization professionals who specialise in assisting boost earnings, bringing credit possibilities, and managing payroll. Select business checking, business credit cards, vendor features or check out our very own business funding cardiovascular system. Mobile deposits may take different amounts of time to clear, dependent on multiple items in addition to each party’s standard bank, membership records and you will membership versions.