Should your credit history deteriorated or you obtained a lot a lot more credit agreements since you home loan try acknowledged, it might not be the ideal time for you make an effort to renegotiate a much better rate of interest

This new motivation at the rear of this really is that value, credit history and financing so you’re able to value’ (the value of your house as compared to brand spanking new amount borrowed) could have increased dramatically historically.

For individuals who still shell out their month-to-month rate of interest savings towards the your property mortgage, you’ll pay it off quicker and you may cut so much more.

Repaying good R600 000 mortgage over 20 years having mortgage loan away from nine.75% will surely cost R5 monthly. The complete fees over 2 decades (the normal home loan name) could well be R1 365 .

A similar financial number with an intention speed from % costs the home consumer R6 30 days. The fees might be R1 461 along the 20-season months.

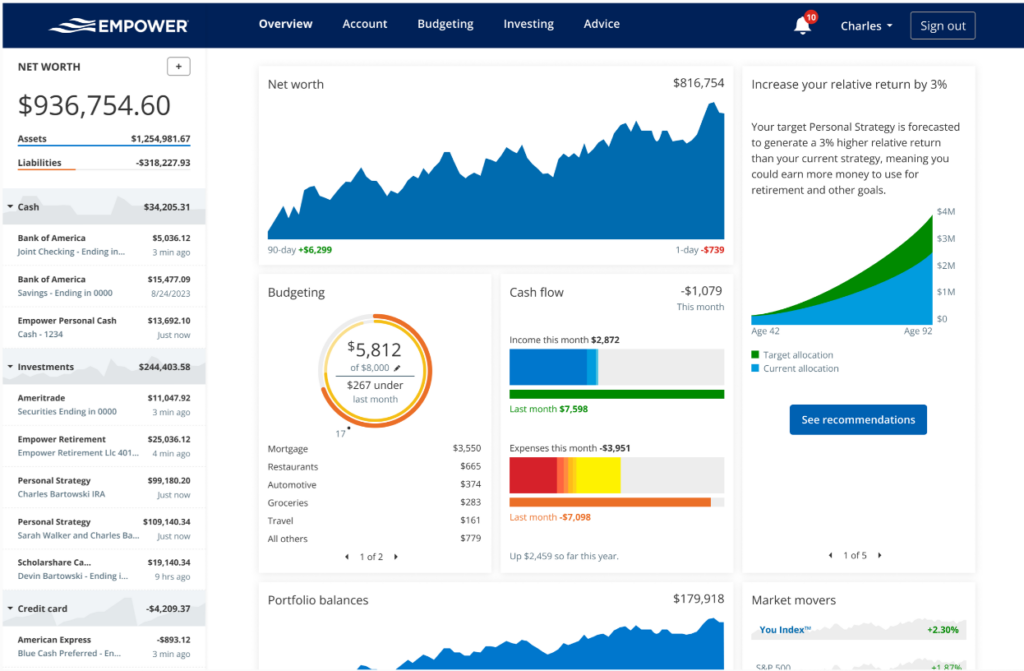

In the event that Charles obtains less rate of interest [quicker 1 %], couple of years later on, he can continue steadily to afford the R stored monthly on their bond, as he has started to become used to it percentage. He can shave regarding two years and you will six months of your own financial and save yourself a much deeper R104 .

The house financing would-be reduced over 17 age and you can half a year, shaving 2 yrs and you can 6 months off the 20 year house financing title.

The expense of cancelling the old mortgage out-of +/- R3 500 while loans in Kirk the brand new subscription can cost you away from R20 getting a great R600 financial, would-be a small bills than the savings calculated a lot more than, states De- Waal.

Charles and his awesome partner can qualify for a beneficial R70 000 FLISP subsidy. Thus the FLISP subsidy will be subtracted from the 100% home loan taken out and a reduced financial matter used to own. A lower life expectancy financial number and a deposit (utilising the FLISP subsidy as a deposit) create enable the standard bank to help you accept a home loan a lot more easily, and then have give less rate of interest.

More resources for FLISP subsidies, look at the FLISP suggestions web site. In order to determine new FLISP subsidy you could potentially qualify for, click

Before you make an effort to renegotiate your property mortgage, earliest make sure your economic ducks’ can be found in a row. Do not submit an application for a diminished financial rate of interest if the your budget and you may credit history commonly match sufficient to have a different sort of negotiation’, states De Waal.

On the home loan application of Charles, neither this new estate agent, mortgage founder or even the five biggest loan providers noticed very first figuring the new FLISP Authorities subsidy you to definitely Charles could qualify for

Your current good credit score, your own value while the property value your residence is the key elements that allow you to renegotiate a much better financial interest rate.

You can begin performing your own on line borrowing from the bank and you will affordability score monitors evaluate should your element increased for the past long time, additionally the prospective new home financing you are able to qualify for.

Click here to have an on-line credit score assessment and you may cost computation, all-in-one. Might discover a certification familiar with echo brand new it is possible to house mortgage that you might qualify for.

This post is a broad suggestions sheet and cannot end up being used or made use of since the courtroom and other expert advice. Zero accountability shall be recognized for any errors or omissions nor when it comes down to loss otherwise damage as a result of dependence on people suggestions here. Always speak to your legal adviser to have particular and you may detail by detail recommendations. Mistakes and you will omissions excepted (E&OE)

Aren’t getting caught with the same interest rate into the remainder of your house mortgage fees months. It does ask you for tens of thousands of rands across the fees period away from home financing label that can offer up to 20 or three decades. Whether your latest financial does not want to renegotiate and lower your property mortgage speed, connect with yet another bank and you will negotiate a reduced rate of interest.