A time had to be built you to definitely anticipate the latest applicant time to resolve their borrowing

To arrive which profile out-of seven-decades, new Agencies believed that of several claims utilize a beneficial 7-year law away from restriction having creditor states. S.C. 1681 ainsi que seq., that’s a national rules you to manages the brand new collection, precision, and you will confidentiality of consumers’ credit information. One of many arrangements away from FCRA are a requirement so you’re able to prohibit of credit history extremely sorts of derogatory borrowing from the bank one antedate the report of the more than seven many years.

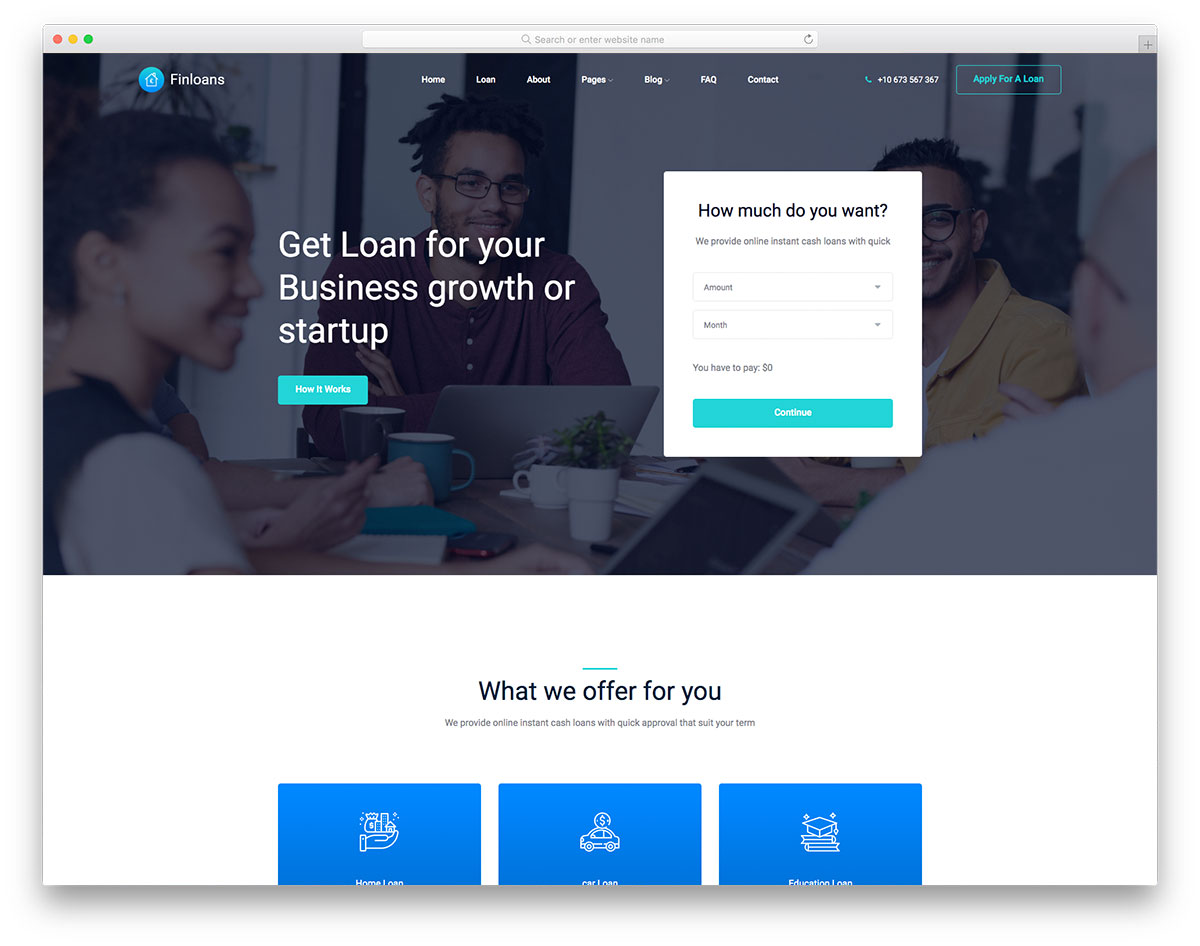

Whenever comparing the general applicants’ credit history, lenders thought numerous situations, including the applicant’s money, assets, credit score, and recommended collateral.

The fresh Agencies determined that seven-many years is enough time for an improvement on these points. Instance, during the seven many years, a candidate could have significantly enhanced its income because of the getting an excellent occupations advertisements, improve, completing a diploma, training an alternative trade, obtaining an alternative experience, credential, or equivalent creativity. to help you validate activities enjoys altered. Having an increased prospective installment element, or improved capability, to make the financing repayments to your 31-12 months identity plays a role in the fresh new applicants’ underwriting studies.

The new Agency including figured 7 ages is enough going back to new candidate to help expand generate its economic climate, from the obtaining additional assets and you can cutting its liabilitiesparing the property to help you liabilities facilitate know if the new candidate is also suffer the latest financial disease and you will, even more important, in the event the a difficulty arose, if they have enough supplies to make certain continued fees. Alongside which have for you personally to receive career advancement, this will create longer with the applicant to improve its discounts. Throughout the 7-seasons period of time, the latest applicant are entitled to discover matching loans by employer within their 401K or 457 bundle, or even found enhanced earnings providing them to set more aside within the savings. This will be necessary for the money possessions and supplies readily available on applicants’ underwriting analysis.

The past items the brand new Company believed inside the determining the brand new eight-12 months period was borrowing from the bank. In an effective seven-season time period the candidate could have time for you repair or reconstruct the credit score, lower otherwise pay off expense, and you can boost their overall borrowing condition, and credit rating companies perform not any longer report of several indications out of derogatory borrowing from the bank eight years once their thickness. With lots of time so you’re able to re also-establish borrowing, new people can display increased fees power to the possibility bank. New Agencies believes one to by basing the newest eight-seasons time to your both regulatory credit scoring legislation and a beneficial reasonable time period towards the people to be able to re also-introduce by themselves, the fresh new people is also obtain finest a career, obtain more money, and you will eradicate a formerly discolored credit history about 7 decades.

Thus, playing with a seven-12 months period of time to consider a previous loss boast of being tall derogatory credit is well-supported

Already, eight CFR region 3555 doesn’t have a flavoring need for streamlined or low-smooth re-finance funds. The latest seasoning period to have a mortgage loan is the period of time the latest applicants have seen its mortgage and $255 payday loans online same day North Dakota made payments to your your debt on their servicer. Which proposed signal intends to modify the current seasoning conditions for smooth otherwise non-smooth refinance financing.

The new smooth-let home mortgage refinance loan currently possess an excellent several-few days seasoning requirement, hence so it recommended laws do tailor to a six-day flavoring requirements. Most other Federal Companies offering comparable applications, one another demanding limited debtor borrowing from the bank and you may underwriting files, such as for instance FHA and you will Virtual assistant, allow it to be improve refinance deals after a half dozen-month span of time. So it advised signal manage give surface with our Businesses by allowing the current mortgage to only feel seasoned half a year prior to getting qualified to receive an effective refinance.