Was a beneficial 680, 700, otherwise 720 Credit score An effective? What’s the Huge difference?

One of the primary articles on this website was about credit results. Its absolutely one of several first fundamentals from private financing you to definitely in some way, some one merely neglect. You to blog post, Save yourself Thousands of the Expertise Your credit score , brings good macro look at fico scores and you may just what every goes in strengthening her or him. This article is planning to dive towards the so much more particular concern regarding whether or not a great 680, 700 otherwise 720 credit score is right.

To most, this is the typical rating as you is to aim to end up being 750+. Yet not, if you’re younger and don’t have very much credit rating, this could in fact end up being an effective first rung on the ladder thus you shouldn’t be disappointed. A rating from 650 is what really institutions believe to-be the brand new range ranging from bad and you may a beneficial. Therefore by having a rating out-of 680 or more than, you are during the an effective starting location.

In fact we-all initiate someplace and most of your own big date our very own initial credit score was a lot less than just these types of wide variety. When you ought not to freak-out, in addition, you of course cannot ignore the situation.

What’s Bad, A beneficial, and you may Higher?

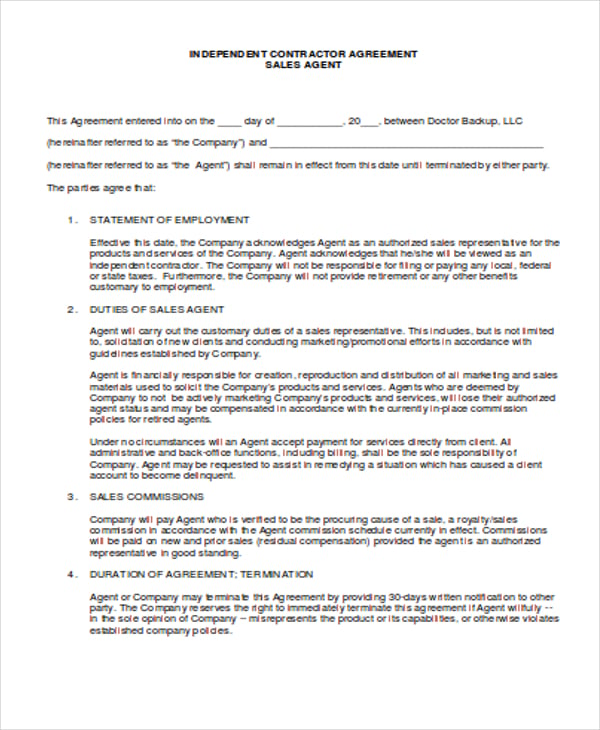

Most of the entity one tips or uses fico scores is about to has actually other parameters for just what they believe as bad, an excellent, and high however, there are overlapping layouts. About blog post I mentioned throughout the opening section, I published this photo:

This is probably one of the best representations of one’s scale away from credit scores from the real world but there are a few deviations.

For starters, particular associations might have other beliefs that can set you for the good finest otherwise tough bracket. It is vital to notice here that in case I state place, I don’t always indicate banking companies. This is because more individuals was checking their borrowing from the bank score. For instance, for many who affect inhabit a condo they most likely usually look at the credit. Which rating make a difference the deposit number, rent count, or if perhaps additionally they deal with the job to start with.

Rates of interest

It’s impossible to explore fico scores rather than discuss the latest impact he’s with the rate of interest you’ll end up spending into that loan. When you are their get normally influence should you get approved regarding fantasy apartment, the greater and a lot more high priced perception might possibly be when you go to purchase a home.

Interest rates is carried on to go up and banks is actually firming the fresh limits for all of us in order to qualify for a home loan. The mixture of these two anything produces having a robust borrowing get more to the point.

Do not let this scare your in the event since if your score was 680, 700, otherwise 720 however nonetheless envision you’re in a fairly a beneficial standing. What can happen in case your bank altered the rate during the 700 regardless of if? Like, a good 680 credit rating received a 6% rate of interest and you will good 720 acquired 4.5%.

For people who ordered a $a hundred,100, house simply how much total focus would you getting investing over the lifetime of a loan? This is actually the math:

This easy difference in a two% interest costs nearly $forty-five,000 for the interest across the life of the mortgage. If you are a beneficial 680, 700, or 720 credit history is good, it’s elitecashadvance.com fast loan just not high and the best possible way to find the best interest rate is to try to remain boosting your get.

Constantly Just be sure to Improve your Credit rating

Life is a lengthy-title online game and whether or not you love it or not, building a credit history are a part of lifetime. Sure, it’s a monotonous matter to take into consideration however, one thing which will conserve me personally several thousand dollars is something that I am searching for, and you will feel as well.