- Make sure the monthly payments work for you. Explore one loan’s repayment terms and conditions to make sure you is pay for they. Tune into the annual percentage rate (APR) as well as the fresh costs to be certain you can shell out back the complete cost of the fresh investment.

- Find out if your be considered. Review the brand new Faqs on loan and figure out facts such as for example lowest credit rating and decades in business. Make sure you strike the mark just before sending in an application.

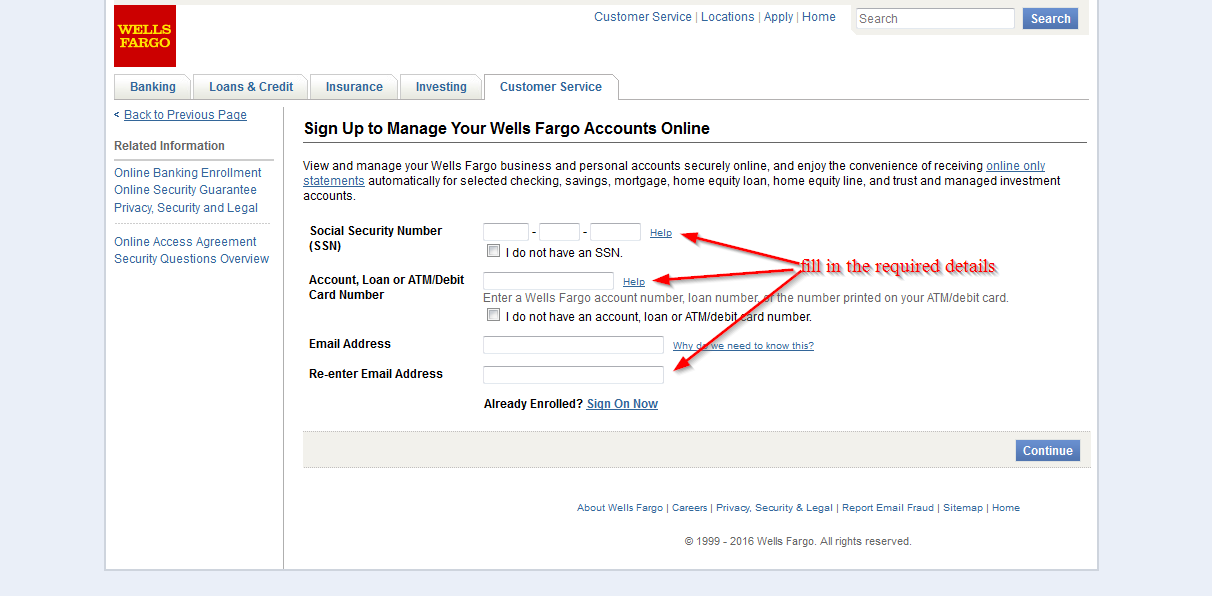

- Use. The best small business fund must have effortless online loan requests as possible over right from your own home in a number of small moments. When you find yourself approved the of these alternatives, it has to only take a few working days – otherwise less – to possess resource to-arrive on the company checking account.

Although it is generally simple and $500 loan with poor credit in Allgood fast to track down one of them financing, it is preferable to not hurry to the organization financial obligation. Always initiate your pursuit on lowest Apr discover, that can lower the total cost off credit as well as your financial weight. This translates to probably more traditional loan providers, such as for instance banks or credit unions. Read your credit score observe how you can improve your own score.

But when you had been refused from the almost every other loan providers while require the currency, an option bank that gives easy team money possibilities might be higher. Also, when you have an emergency at your team otherwise find chances which have a finite go out window, an easy providers mortgage can help you away.

Nav suits just about any version of business, and you can all of our advantages will suits one suitable fit for your company means.

Exactly how Nav Allows you to find the best Team Financing Alternatives for You

Nav is here now in order to find the correct financial support. That is our business. We first render small business owners having alternatives – our financing markets have more 70 financial support solutions out of over fifty various other loan providers.

If it feels like a formidable level of options, we can opt for the correct selection for you. After you create a totally free Nav account, i bring your goals along with your organization investigation for connecting your small company on the best financing. As well as, your enterprise is step 3.5x prone to get approved having financial support if you get matched up thanks to Nav.

Is-it An easy task to Get a keen SBA Mortgage?

It depends. Small company Administration (SBA) financing are a highly prominent investment solution since they’re more affordable in order to borrow. They are backed by the federal government, so they really provide lower interest rates and count reduced on the creditworthiness than other possibilities. And the SBA loan system is designed to allow it to be more comfortable for smaller businesses in order to be considered in comparison to antique loans.

But not, the borrowed funds process can be more difficult than just delivering an easy team loan. Like, you will have to render much more files than of a lot simple business loans need, eg a corporate package, financial statements, and you can a business anticipate, and you’ll must build up your organization credit history. Click on this based on how to ascertain providers credit.

What’s the Trusted SBA Loan to locate?

When you find yourself searching for an enthusiastic SBA financing but can’t a bit meet the requirements, look into SBA microloans. Talking about perfect for small business individuals who are in need of an inferior loan amount – you can borrow a lump sum off ranging from $five hundred and you can $50,100 to improve cashflow. These types of SBA finance also provide resource getting things such as working-capital, collection, offers, and much more.

That it mortgage could be the best option getting business owners which never meet with the credit conditions from antique loan providers, otherwise that are with a lack of credit rating. Rates of interest normally fall between 8% and you can thirteen%, that is reduced than many other effortless business loans. As much date you can achieve pay the newest loan try six ages. To put on, you’ll want to look the newest SBA website to possess a performing organization in your community you to acts as a mediator bank for these fund.